CANGO Auto View: Behind the takeoff of NEVs: Who will win the battle of power battery technology?

Back in 1876, Nicolaus August Ouo, a German, made a four-stroke gas engine with his friend Eugen Langen. The thermal efficiency of this engine reached 6%, which was four times that of the gas engine made by Lenoir around the same time. The internal combustion engine thus came into being, ushering human society into an era of dependence on internal combustion engines for passenger vehicles, heavy trucks, ships, aircraft and many other means of human mobility. Petroleum energy became, as a result, increasingly critical.

On the other hand, it has been more than one century since humans invented and used EVs. In as early as 1881, French engineer Gustave Trouvé built a tricycle powered by lead-acid batteries. But because of backward technology, batteries were not as economic as internal combustion engines and were therefore not used on a large scale.

Fast forward to 2020. Since that year, with the advancement of new energy technology, auto companies worldwide have begun making plans for EVs, resulting in a series of pure EV launches. European passenger vehicle companies led by Volkswagen plan to invest hundreds of billions of euros in the electrification field and introduce hundreds of car models. It is reported that Volkswagen has rolled out mass production of models based on its pure electric platform MEB, and that ID.3 has been crowned Europe’s leading pure EV offering.

In China, Tesla, Nio, Lixiang, WM Motor and other emerging carmakers have been making a name for themselves, and traditional auto companies have been launching one new energy brand after another.

In 2018, BAIC BJEV set up a joint venture with Magna, and the brand ARCFOX found its home in Zhenjiang; DFMC incubated Voyah; SAIC, Alibaba and Shanghai Pudong New Area invested together and set up IMMotors; and three years after its establishment, GAC Aian officially started independent operation. Multiple parties have taken the stage to jointly usher in the era of emerging carmakers.

Judging by available data, the domestic NEV market has maintained a steady growth. As of November 2020, cumulative sales of NEVs in China has reached 1.109 million vehicles. In 2019, 1.242 million NEVs were produced in China, which was a YOY decrease of 2.25% over the 1.27 million of 2018, but a YOY increase of 58.37% over the 517,000 of 2016. It is worth bearing in mind that in 2014, only 79,000 NEVs were produced in China.

In terms of industrial chain structure, NEVs are similar to traditional gas-powered vehicles in that their industrial chain involves multiple industries and a relatively complex chain of players. The industrial chain of NEVs, however, is structurally different from that of traditional vehicles, because the biggest difference between these two types of vehicles is that engines in traditional vehicles have been replaced by motors, batteries and electronic control parts in NEVs. In other words, on the base of the traditional industrial chain, the battery industry (including upstream resource development), motors and electronic control systems have been added to the industrial chain of NEVs.

Battery safety still an issue with EVs still in their early stage of development

While NEVs are experiencing a gradual growth, China’s power battery industry has entered a phase of rapid development. In 2019, the scale of China’s power battery market exceeded 70 billion yuan and power battery output amounted to 71GWh. Behind the rapid growth, however, the future trend of new energy battery technology and current battery safety have triggered heated discussions across society.

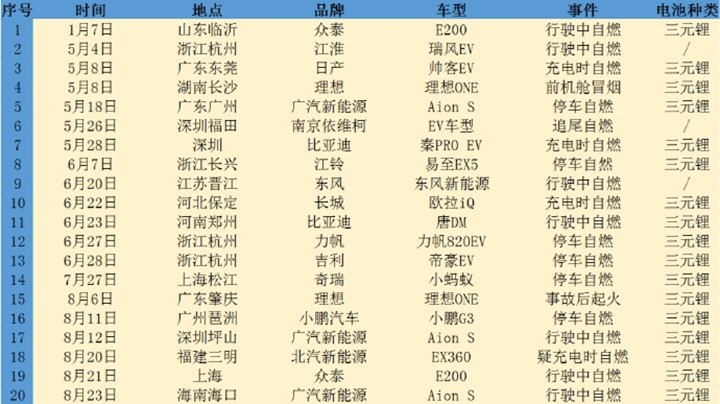

Over the last three years, China has seen spontaneous combustion of NEVs from time to time. Statistics show more than 20 such accidents for this year alone, involving multiple domestic and joint venture brands.

(Statistics cover 2020 only)

According to statistics, the main reason for EV fires is spontaneous combustion caused by thermal runaway, which happens following external impact on batteries or improper control of the batteries. For example, spring and summer are high-incidence seasons for electric vehicle fires, mainly because battery performance changes as a result of long periods of high temperature, rain and other environmental factors. In addition, the use of high-energy-density batteries, battery overcharging and physical collision will lead to changes of the battery internal structure which, in turn, will lead to spontaneous combustion.

Tesla founder Elon Musk insists, however, that the odds of spontaneous combustion are lower for most EVs than for gas-powered vehicles. And he is right. According to the Battelle Memorial Institute in the US and multiple other institutes, from a technical point of view, EVs indeed have a lower risk of spontaneous combustion than traditional gas-powered vehicles.

One fact worth noting, however, is, the car parc of EVs is relatively low. Because EVs are still in the initial stage of industrial development and consumer acceptance is not yet high, safety issues should be even more closely monitored.

OEMs and battery manufacturers actively investing in and exploring new technology

NEVs currently on the market are mostly powered by lithium batteries. Accounting for more than one third of the cost of the entire vehicle, power battery is the core factor dictating a vehicle’s performance.

In terms of battery materials, because of the rising energy density bar for power batteries to receive subsidies and consumer preference for long-range vehicles, ternary lithium battery with its superior energy density is the current market leader and installed in more and more vehicles from year to year. Besides ternary lithium battery, lithium iron phosphate battery, lithium ion battery, lithium manganese oxide battery and multi-element composite lithium battery also enjoy certain market shares. In terms of trend, all of the power battery companies are trying to enhance battery energy density through improving the material systems and lightweighting.

With that in mind, auto OEMs are accelerating the deployment of their power battery business. In as early as 2017, Toyota and Panasonic established a joint venture called Prime Earth EV Energy focusing on prismatic batteries for hybrid vehicles. In 2019, the two parties joined forces again, planning to set up a vehicle battery joint venture, to work together to develop and produce high-capacity batteries for EVs, and to mass produce these batteries by 2025.

Moreover, in 2019, Toyota established formal partnerships with CATL and BYD in a fully open cooperation in the field of pure electricity. The partnerships will not be limited to the supply of power batteries. Instead, they also cover battery recycling and the development of pure EVs.

In 2020, in collaboration with scientists from Kyoto University, Toyota developed a new fluorine ion battery. The energy per unit weight of this battery is approximately seven times that of the traditional lithium ion battery, and one charge delivers a range of 1000km. According to Japanese media reports, this joint team has successfully developed a rechargeable prototype of this battery using solid electrolytes, with the cathode made of fluorine, copper and cobalt and the anode made mainly of lanthanum.

In 2019, Volkswagen also entered the power battery business through shareholding in a lithium battery company called Northvolt, for the mass production of batteries. The Volkswagen Group plans to invest 900 million euros in battery R&D in collaboration with Northvolt. Northvolt benefits from strong investment endorsement from government agencies and large-scale enterprises, having received more than 1.4 billion euros to date.

Volkswagen’s heavy investment in Northvolt has to do with the global manufacturing footprint of high-end power batteries. At present, the main high-end battery technology is owned by a handful of companies including Panasonic, CATL, Samsung SDI, LG Chem and SKI. In order to control such a core part as power battery and to ensure supply chain security, auto companies are driven towards extensive investment and collaboration with power battery companies.

Tesla is no exception. In 2019, it announced the acquisition of supercapacitor maker Maxwell, at a premium of 55%, for 218 million US dollars. By absorbing external technical teams to focus on deploying in battery technology in the future, Tesla is also further driving coordinated development with energy storage business and solar technology. Maxwell’s high-energy high-density batteries and its engineering design for battery pack and chassis can help Tesla achieve even lower energy consumption and longer driving range for its products.

Breakthroughs in battery technology is one of the main topics for carmakers. In 2020, GAC Group announced that it was continuing research into graphene battery and expected to pilot mass production for real vehicles by the end of this year. Whether mass production can happen eventually will be determined by the test results.

It has been reported that the graphene battery developed by GAC can be charged with 80% full power within eight minutes, so that a 10-minute charging can translate into a driving range of 200-300kms. This charging speed is comparable to gas refueling. At present, GAC is running preliminary tests of the graphene technology on multiple levels including battery cells, modules and installation on vehicles. Based on its previous plan, the graphene super-fast charging battery will be mass produced and installed on the Aion series of vehicles.

Domestic independent brands are also fully deploying in the entire power battery industrial chain. Take GWM for example. SVOLT was set up to help GWM resolve issues such as scarcity of high-end power battery cell production capacity. Outside China, SVOLT has invested a total of 2 billion euros to build factories in Europe with a total production capacity of 24GWh. It has, in fact, announced the establishment in Saarland, Germany, of a module PACK factory and a battery cell module factory. The former will be in production as early as the second quarter of 2022 while the latter will be in production at the end of 2023.

In terms of more cutting-edge battery technology reserves and development, SVOLT leverages the Wuxi 118 Global Lithium Battery Innovation Center as its platform, and is exploring new lithium technology for the next decade through preliminary development of technology and products including all solid-state battery, capsule battery, self-gassing battery and hybrid cathode materials.

Mathew Effect in the continuous breakthroughs in battery technology

Judging by the intensity of investment from major manufacturers, this arms race in terms of battery technology is far from over. For one, cost is one of the most important considerations for power batteries. Cost has been dropping thanks to years of technological development. At present, battery prices are one fifth of those of ten years ago, and the cost of battery as a percentage of whole vehicle cost has dropped from 60% from five years ago to 30%-40%. Still, since price parity is the most important factor restricting the deeper penetration of EVs, battery cost still relies on continuous breakthroughs in materials, scale and technology.

For example, in battery development, it is still necessary to find low-cost material systems, reduce the use of parts, and develop batteries that do not use precious metals or do not use metals at all. Cobalt is a rare earth metal that is indispensable to the positive electrode of ternary lithium material, because it can not only stabilize the laminated material structure but improve the material’s cycle and rate performance. The demand for cobalt will keep rising with the rapid development of NEVs.

The earth’s cobalt content, however, is relatively low. Limited cobalt resources dictate high prices of the metal, and supply might fall short of demand in the future. Confirmed terrestrial cobalt resources worldwide are 25 million tons and reserves 7.2 million tons. Global cobalt resources are actually very unevenly distributed, with cobalt reserves highly concentrated in Congo (DRC), Australia and Cuba. To be more specific, the combined cobalt reserves of those three countries account for 68% of total global reserves.

Being cobalt-free is one of the common goals in the research and development of power battery material systems. In 2020, an executive from CATL revealed that the company is developing a new type of EV battery that does not contain nickel or cobalt. Nickel and cobalt are key components of the battery that powers EVs. Many battery manufacturers including Panasonic in Japan and LG Chem in South Korea are reducing the amount of the expensive cobalt used in NCA or NCM batteries. Moreover, CATL is developing a separate technology to directly integrate batteries into the frame of an EV so as to increase its driving range.

In May 2020, SVOLT, a battery company under GWM, debuted the NMx cobalt-free battery it had developed. Through the cation doping technology, single crystal technology and nano-networked packaging, this battery has significantly improved nickel-lithium ion mixing and cycle life in the absence of cobalt, suggesting the possibility for cobalt-free materials to overcome these key obstacles and reach the stage of large-scale applications.

Besides rare metals, battery materials are one of the focuses for the major manufacturers in their business deployment. Currently in the market, cathode materials used for lithium power batteries in NEVs include ternary materials, lithium iron phosphate, lithium manganese oxide and lithium cobalt oxide.

CATL, for example, has chosen to focus its investment on the production of cathode materials and lithium resources required for the production of cathode materials. In September 2019, it announced the plan to purchase 8.5% of the shares of Pilbara which is a lithium mining company in Australia. And in April of the same year, it announced that its subsidiary CATL Bangpu would invest in the construction of production capacity of 100,000 tons/year of nickel cobalt lithium manganese oxide cathode materials.

In raw material supply chain, the competition to integrate upstream resources is particularly fierce. Take Gotion High-Tech for example. Since its establishment in 2006, this power battery company has dedicated itself to the independent development, production and sales of lithium power batteries for NEVs. In 2019, the company’s power battery installation volume was 3.2GWh which translated into a domestic market share of 5.2%, ranking third in the country, after CATL and BYD. Of the 3.2GWh, lithium iron phosphate batteries accounted for 2.9GWh, ranking second in the country.

As of now, Gotion High-Tech has deployed in nickel, cobalt and lithium resources as well as the four major raw materials of batteries (cathode materials, anode materials, separator and electrolyte) so as to further enhance the company’s cost advantage. Its subsidiary Gotion Precision Coating Materials Co., Ltd. has started mass producing carbon-coated aluminum foil, and is collaborating with MCC to develop ternary precursor materials and with Tongling Nonferrous Metals Group Holdings Co., Ltd. to develop copper foil, and co-investing with Shenzhen Senior Material Technology Co., Ltd. in separator development and with Shanghai Electric to enter the energy storage field.

In terms of clients, Gotion High-Tech has established strategic partnerships with a large number of outstanding domestic vehicle companies including BAIC, SAIC, JAC, Chery, Changan, Geely and Yutong. At the same time, the company is accelerating its internationalization. It has entered the Bosch global supply chain system and set up a joint venture with Tata in India to develop the Indian lithium battery market. On May 28th, 2020, Gotion High-Tech announced the plan by Volkswagen China to make strategic investment in the company.

Competition on the technical level is even more complicated, and there were times when multiple technical routes were taken. Take battery packaging for example. It is one of the key technologies that affect battery safety and life. Based on market analysis reports, since power battery products are used in different scenarios, impact resistance, vibration resistance and resistance against mechanic shocks such as squeezing and puncturing are one of the requirements for battery packaging. In addition, battery packaging needs to meet chemical requirements such as fire retardant requirement and immersion requirement, and to meet lightweight and wiring requirements in terms of design. Therefore, power battery packaging does have a certain technical threshold.

Power battery research has shown that at present, based on the sub-assembly technology, power batteries can be divided into three types, namely, prismatic battery, cylindrical battery and soft pack battery. And each has its advantages and disadvantages.

1) A prismatic battery, as the name suggests, refers to a single battery made into a prismatic shape. Compared against cylindrical packaging, the prismatic shape narrows the gap between cells and allows internal materials to be rolled more tightly. As a result, the battery will not easily expand when restricted by high hardness, which is relatively safe. Moreover, the shell is made of aluminum-magnesium alloy which is lower in density, lighter in weight and higher in strength, thus enhancing the battery’s energy density and safety and range.

2) Both cylindrical batteries and prismatic batteries come in hard shells, but the cylindrical packaging distinguishes itself with its small size, flexible grouping, low cost and mature techniques. At present, the Panasonic batteries used in Tesla’s pure EVs are hard-shell cylindrical batteries. In the later stage, however, the cylindrical battery will face issues such as difficult post-grouping heat dissipation design and low energy density.

3) Although the soft pack battery has advantages such as flexible size change, high energy density, light weight and low internal resistance, it also has disadvantages such as poor mechanical strength, difficult sealing process, complex grouping structure and difficult design. Even in cost, consistency and safety, it is of average performance.

At present, prismatic packaging is the most common battery packaging in China. Of the three different shapes of battery, namely, prismatic, cylindrical and soft pack, prismatic batteries still dominate the market and are the only technical route maintaining an YOY increase in 2019. In 2019, the installation volume of prismatic batteries was 52.73GWh, which was a YOY increase of 24.8% and accounted for 84.5% of the total installation volume.

The three companies with top installation volumes are CATL, BYD and Gotion High-Tech. An oligopoly effect has been formed in this field, and studies suggest that the leading position of prismatic batteries will not change in the short run.

Furthermore, most of the major technological breakthroughs are accredited to the leading companies. Take the efficiency of battery packs for example. In a traditional battery system, the costs of the battery’s internal structural parts and packs are relatively high. Non-modular technology is expected to improve battery pack design, enhance battery pack efficiency, and optimize layout, structure, topology and low-density materials, thereby reducing costs.

In September 2019, CATL launched the CTP technology at the Frankfurt Motor Show. With the CTP technology, the volume utilization rate of battery packs can be improved by 15%-20%, the number of battery pack parts reduced by 40%, and the energy density of battery packs increased by 10%-15% to above 200Wh/kg. At the same time, the number of intermediate links can be minimized, production efficiency improved by 50% and production cost of power batteries dramatically reduced.

In March 2020, BYD introduced its new-generation blade battery. By increasing their length, the battery cells are flattened. And with the densely arrayed cells acting as structural parts themselves, sufficient strength is maintained to provide support, thus eliminating a part of the traditional battery pack protective structure and improving the space utilization rate inside the battery pack shell from 40% of the tradition design to 60%. At the same time, the new blade battery features further improvements in battery life, range, safety performance and grouping efficiency, and its cost has been reduced by 20%-30%.

More technological breakthroughs are expected for the future, and solid-state battery technology, for one, is widely tapped to be the next-generation power battery technology since the number of related patents has increased by more than tenfold over the past decade. But on the whole, the power battery industry features high barriers to entry due to factors including large-scale investment required by the industry, long R&D input-output cycles and technical barriers. With time, the competition among power battery companies will become more heated, and industry reshuffle will be accelerated. The future will be exciting to behold.

沪公网安备 31011502007981号

沪公网安备 31011502007981号