CANGO Auto View: Positive Outlook for China’s Auto Export in the Post-Pandemic Era

The history of China’s auto export is also a history of Chinese automakers growing against all odds.

China’s auto export dates back to the end of the 20th century. In the early years, the Chinese auto industry was still in its infancy, and neither the technology nor the supply chain was mature. As a result, export performance wasn’t gratifying.

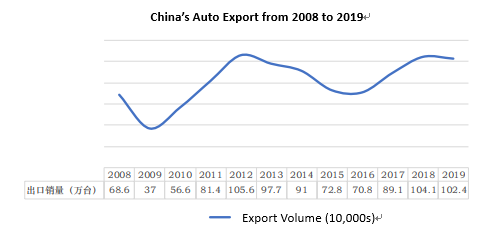

It wasn’t until 2001-2008 that China’s auto export on the whole showed a steady growth trend. In 2009, under the impact of the financial crisis, China’s auto export fell sharply and export volume dropped to 370,000 units. Several years after the financial crisis, China’s auto export rebounded and in fact hit a record high in 2012 with the export volume surpassing one million units for the first time in history.

Since then, Chinese automakers have been stepping up export efforts and transitioning from single product export to strategic overseas industrial mapping as defined by the export of both technology and capital. In the following years, Chinese automakers experienced ups and downs, and export volume again hit the one million mark in 2018. Thanks to the arduous exploration by Chinese automakers, China’s auto export enjoys a positive outlook.

Challenges and opportunities co-exist for China’s auto export

Since the beginning of this year, due to COVID-19 and other factors, the road has been bumpy for Chinese automakers in their export efforts. In mid-July, data released by the General Administration of Customs showed China’s auto export volume to be 386,000 units for the first half of 2020, which was a year-over-year decline of 20.9%.

At present, the worldwide pandemic caused by COVID-19 is still dangerous and showing no sign of improvement in countries including India, Iran, Russia and Brazil. Some countries even adopted measures such as closing borders to prevent the spread of the pandemic. In India, for example, the closing off of the country has led to temporary closing of auto dealers, and in April 2020, India’s auto sales volume was zero for the first time in history. As all of the aforementioned countries are key areas for Chinese automakers’ export and investment, a large number of Chinese automakers have chosen to shrink or suspend relevant business.

On the other hand, changes to monetary policies and the global environment pose risks to auto export. In 2014, for example, because of the depreciation of the Russian rupee, brands including Chery, Lifan and Geely suffered huge losses, and a lot of overseas auto brands fled Russia. Similar risks occurred in 2019. Under the impact of US sanctions, China’s auto export to Iran dropped 99% year-over-year. And Iran being the market with one of the heaviest volumes for Geely export, Geely reported a 24% year-over-year decline in its export volume for last year.

Impact of the global macro environment aside, on the product level, the export competitiveness of China’s auto products is higher than that of Brazil and India but significantly lower than that of Japan, Germany and other countries. Judging by the overall export data, China’s export of auto products is on a relatively small scale, and auto products account for a relatively low percentage of China’s merchandise export. Compared against other major auto producing countries, auto products should have accounted for a higher percentage of China’s merchandise export.

This, however, will not thwart Chinese automakers’ export efforts. A look at worldwide auto sales shows that in 2019, China produced and sold 25.721 million and 25.769 million autos, respectively, and the one million autos exported by China accounted for only 4% of domestic production. In comparison, in 2018, Korea exported as many as 2.45 million autos, which accounted for 61% of its domestic production, and the percentage was even higher for Germany, which was 78%.

The Chinese auto industry is currently in the critical stage of transitioning from quantitative change to qualitative change. The sudden onset of the pandemic has temporarily slowed down Chinese automakers’ export efforts. But the big picture is that Chinese automakers still have great potential for venturing into the overseas market, and more lenient policies guiding the export of China’s new-energy and second-hand vehicles are laying a solid foundation for China’s auto export in the post-pandemic era.

A large number of Chinese automakers have set up plants overseas and established foothold

As a matter of fact, Chinese automakers have formulated a relatively stable methodology for venturing overseas. At present, in order to stabilize their markets overseas, Chinese automakers mainly follow localization strategies under which the focus is to set up high-level manufacturing sites and marketing networks in key countries and markets.

Take, for example, SAIC Motor. In 2017, it announced the establishment of the first joint venture plant in India to be used for the production of its MG models. It adopted a series of localization measures, including attracting its parts suppliers SHAC and Yanfeng Adient to set up plants in India so as to provide the MG joint venture with chassis parts and seats, and setting up parts logistics centers, test tracks and technical training centers so as to enhance its capacity for serving local consumers.

SAIC Motor isn’t alone in such endeavors. Beijing Auto’s South Africa plant is located in the Coega Special Economic Zone, and as many as 60% of the plant’s auto parts and materials are locally sourced in South Africa. This plant created 1500 jobs during the first phase and will create another 2500 jobs once construction of the plant is fully completed. In July 2017, Wuling’s auto plant in Indonesia was put into operation and localization rate of the first product was as high as 56%.

Besides localized manufacturing sites, Chinese automakers’ marketing outlets all over the world are important physical entities for carrying out their overseas sales. As of the end of 2018, Chinese automakers have established more than 9700 overseas sales service outlets and more than 7100 overseas after-sales maintenance and repair outlets, and their overseas maintenance and repair personnel totaled 56,200.

Of the Chinese automakers, GWM has succeeded in covering more than 60 countries including Russia, South Africa, Australia, Ecuador and Chile with its 500+ overseas networks. It also owns KD assembly plants in Russia, Thailand, Malaysia, Ecuador, Tunisia and Bulgaria. Chery products have been exported to more than 80 countries all over the world, and its cumulative vehicle export has exceeded 1.6 million. Outside China, it owns 10 manufacturing sites and more than 1300 sales service outlets, and for 16 consecutive years, it has exported more passenger vehicles than any other Chinese auto brand. SAIC Motor has set up three overseas innovation and research centers in countries including the UK, three auto manufacturing sites in Thailand, Indonesia and India, respectively, 95 parts manufacturing sites overseas, 12 regional marketing and service centers in Europe, South America, Africa, the Middle East, Australia and New Zealand, more than 600 marketing service outlets all over the world, and its first overseas financial services company in Indonesia.

With the aforementioned measures, local consumers are provided with high-quality services on one hand, and on the other hand, preferential policies from foreign regional governments are leveraged for tariff reduction or exemption so as to enhance Chinese automakers’ competitiveness at their overseas bases. The physical outlets located all over the world have laid the foundation for Chinese automakers to establish a strong presence overseas. And once China’s independent brands have set up their own sales companies in foreign countries and started deepening collaboration with local governments and automakers in technology, supply chains and channels, they are saving a large amount of R&D and sales costs for Chinese automakers to venture overseas.

Localized collaboration is just one model. The overseas strategies of China’s independent brands as led by Geely are even more direct, in that these brands deploy in the overseas market through massive acquisitions. In 2010, Geely bought Volvo from GM for USD 1.8 billion; in 2017, it bought 49.9% of the shares of Proton under HICOM and 51% of the shares of the luxury sports car brand Lotus; and in 2018, it bought 9.69% of Daimler shares for USD 9 billion through its overseas corporate entities.

Whatever strategies they adopted over the years, Chinese automakers have left a firm footprint in the overseas market.

Conditions are ripening for the export of new-energy and second-hand vehicles

While Chinese automakers are venturing overseas, new-energy vehicles have become one of the symbols of Chinese auto products. Export data released by Chinese Customs shows China auto export to be 1.22 million units for 2019 which was a 6.1% increase year-over-year, and of the total number, 254,000 were electric passenger vehicles, which was a 73.1% increase year-over-year.

To be more specific, based on data from the China Association of Automobile Manufacturers, in the first half of 2019, BYD and other new-energy buses were entering in bulk developed countries in Europe and the US as well as emerging markets such as Chile, Peru and Brazil, and in 2018, these Chinese brands occupied more than 20% of the European new-energy bus market and in particular, more than 60% of the British market. Xiamen King Long and Zhong Tong Bus enjoy the largest market shares in Taiwan and South Korea. In addition, new energy vehicle parts produced by CATL, Jingjin Motor and other Chinese companies are now on the purchase lists of multinational automakers, and CATL has in fact reached agreements with BMW and many other MNCs on battery supply, thus becoming a world-class power battery supplier.

According to industry analysts, new-energy vehicles being a strategic emerging industry in China, the Chinese government has taken the first steps in establishing a comprehensive policy support system in areas including promotion and application, fiscal and taxation support, technological innovation and infrastructure. With the entire industrial chain covered, from R&D to industrialization to promotion and application, this initiative has effectively propelled the rapid development of China’s new-energy vehicle industry. Driven by policies and the market, the international competitiveness of China’s new-energy vehicle products has risen dramatically and approached or reached international standards in areas including battery, energy consumption and battery life.

Moreover, as energy conservation and emissions reduction regulations become stricter in major countries in the world, new-energy vehicles will gradually take over as the main area for the future growth of the auto market. Over the next few years, China’s export of new-energy vehicles is expected to maintain a rapid growth and to become an emerging force driving the steady growth of China’s auto trade.

Research shows that among developed countries, the US, EU and Japan have all introduced comprehensive measures to support the development and market promotion of the new-energy vehicle industry. Among developing countries, major ASEAN countries have issued supporting policies encouraging automakers to invest in building plants and launch more diversified models of new-energy vehicles. Thailand, for example, implemented zero tariff on electric vehicles imported from China starting January 1st, 2018, and has set for itself the sales goal of 1.2 million electric vehicles by 2036. While Indonesia is promoting new-energy public transportation, Malaysia has set the goal of new-energy vehicles accounting for 85% of total domestic auto production by 2020. All of these are paving the way for SAIC Motor, Geely, Chang’an and other Chinese new-energy vehicle companies to enter the ASEAN market.

On the other hand, as China’s auto products constantly improve in quality, second-hand vehicles find themselves in significantly better conditions. Since developing countries in Central Asia, Africa and Southeast Asia have a huge demand for cheap and reliable second-hand vehicles, China should tap its potentials for exporting second-hand vehicles to emerging markets.

On April 29th, 2019, after in-depth investigation and research, the Ministry of Commerce, the Ministry of Public Security and the General Administration of Customs jointly issued Notice on Supporting the Export of Second-Hand Vehicles in Areas with Mature Conditions. Beijing, Shanghai, Zhejiang (Taizhou), Shandong (Jining), Guangdong, Sichuan (Chengdu), Shaanxi (Xi’an), Qingdao and Xiamen thus became the first ten provinces/cities in China to conduct second-hand vehicle export business.

To resolve issues encountered during second-hand vehicle export including complicated ownership transfer procedures and inconvenient license application and customs clearance, on October 29th, the Ministry of Commerce, the Ministry of Public Security and the General Administration of Customs jointly issued Notice on Facilitating the Export of Second-Hand Vehicles. The policy simplified ownership transfer and registration procedures for second-hand vehicles exported from China, changed export license from “one car, one license” to “one batch, one license”, and implemented an integrated model for customs clearance across China. As a result, the export of second-hand vehicles has become dramatically more convenient.

The industry consensus is that relevant policies have completely opened up export channels for second-hand vehicles. Currently there are no policy barriers in China to the export of second-hand vehicles. On the contrary, as companies vigorously develop the global market and innovate business models, China’s potential for exporting second-hand vehicles will soon be unleashed and in the process, auxiliary products and services such as auto parts and after-sales maintenance and repair will also be exported, which will become a new force driving the high-quality development of China’s auto trade.

Export of joint-venture brands is yet to be tapped

While there are many independent auto brands in China, the Chinese market has become the most important source of sales for major multinational automakers in the world. For example, in 2018, GM’ s sales in China accounted for more than 40% of its global sales. While meeting the demand of the domestic market in China, joint ventures are already well-equipped to export to developed countries and regions in Europe and the US. As a matter of fact, GM, Volvo, Honda and other foreign-funded companies have started using their plants in China to export in bulk to the global market.

MNCs, however, still focus on localized production and sales as part of their strategies in China, and probably under the impact of the global industrial mapping adjustments, foreign-funded automakers that have invested in China apparently lack momentum in export efforts, and their export scale is small or even nonexistent. Nonetheless, as China further opens up and extensively implements the foreign investment management model under which foreign investment enjoys pre-establishment national treatment and the negative list principle, and as the equity ratio of joint-venture whole vehicle manufacturers becomes increasingly liberal, major foreign-funded automakers are contemplating adjusting their strategic deployment in the global market. Should they adopt measures such as becoming majority shareholders of existing joint ventures or building wholly-owned plants, they might be able to expand their auto production in China as well as export.

Take BMW for example. It plans to acquire 25% of equity interest in Brilliance Auto before 2022. Following the acquisition, BMW will become the first company to change the equity ratio of a joint venture, as its Brilliance Auto shares will exceed 50% and in fact increase to 75%. Brilliance Auto will continue to expand investment and production, help promote the upgraded and integrated development of Germany’s Industry 4.0 and China’s manufacturing industry, and activate the collaborated development of third-party markets between China and Germany.

At present, Brilliance Auto owns two world-class whole vehicle plants and one powertrain plant. Its Shenyang plant is one of the largest manufacturing sites in the world for BMW Group, having produced 520,000 vehicles in 2019. The plant will be producing X5 models and engaging in the R&D and production of purely electric models including iX3, and all of these models will be exported.

Volkswagen Group (China) has formulated clear plans with its joint ventures SAIC Volkswagen and FAW-Volkswagen to develop export business mainly targeting countries and regions with emerging markets. Volkswagen will be expanding the export scale of Santana, Tiguan and other best-selling models in China to Southeast Asia and other emerging markets. Through its rich product lineup and integration of sales channels, it plans to export more than 1000 vehicles to Southeast Asia on a yearly basis.

At present, almost all of the foreign-funded auto groups including Volkswagen, BMW, Toyota, Honda, GM and Ford have set up joint ventures in China, and foreign brands have been maintaining a long-term share of 55%-60% of the Chinese passenger vehicle market. As foreign-funded companies enhance their multinational operating capabilities, foreign investment further expands, and The Belt and Road initiative is extensively implemented, joint-venture automakers are expected to further improve their export capacity.